what happens if my bank returned my tax refund

Unless Sarah can protect the entire refund with an exemption the bankruptcy trustee can take 1000 from Sarahs. IRS return and account problems.

12 Reasons Why Your Tax Refund Is Late Or Missing

The best way for you to track your federal refund is to call the IRS at 1-800-829-1040.

. This information is not intended to be tax adviceConsult a tax preparation professional for tax advice. Meanwhile you should give them the correct information so that when the money does come back it. Generally when someone enters the wrong bank account number on a tax return the refund isnt sent anywhere.

If your refund check was returned to the IRS you might be able to change your address online via the IRS website. Answer 1 of 8. When a refund from the IRS is rejected by an individuals bank account it usually takes the bureau up to 3 weeks to send the individual a mailed cheque that is equivalent to the value of the refunded money.

The IRS is requesting a new address to mail the check. June 6 2019 327 AM. This is because nobody is holding an account under that account number.

If your refund check was returned to the IRS you might be able to change your address online via the IRS website. The IRS will create a paper check for your tax refund and mail it to the most up to date address they have on file for you. Call or visit your bank if you gave the IRS an account number containing inaccurate digits.

Giving the wrong account number may have caused the IRS to deposit your refund into the wrong persons account. Check For the Latest Updates and Resources Throughout The Tax Season. Call 1-800-829-1040 to verify your mailing address or your bank account.

It will be sent back to the Internal Revenue Service if it is refused because the account information does not correspond to the name that is printed on the check. If this isnt the case however the financial institution will return the funds back to the IRS. When that bank refuses the direct deposit where it goes back to depends on where it was from.

In 2020 the average taxpayer received a refund of 2741 which is a good chunk of change to stash in savings use to pay down debt or fund another financial goal. Ad Learn How to Track Your Federal Tax Refund and Find the Status of Your Direct Deposit. If you dont provide the IRS with your correct bank account.

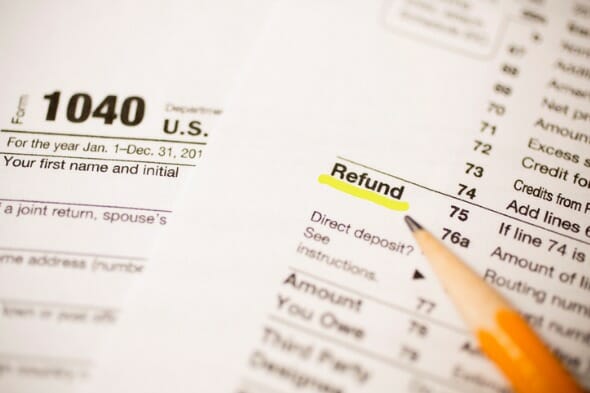

If the deposit fails the IRS will attempt to issue you a check. It will take a while hit the money will eventually be returned to the IRS. Most common tax problem area.

Where are you currently located. Can you help me. If you want to change your bank account or routing number for a tax refund call the IRS at 800-829-1040.

The Accountant can help. Account information or change. I checked with my bank about my tax refund and it was returned to the IRS because I had given you the wrong account.

What happens if my tax refund is rejected. It normally takes 3-4 weeks. If you havent yet filed your return or if the IRS rejected your return.

However sometimes it another direct transfer may be attempted in such cases the money reached the individual within a week. If the return hasnt already posted to our system you can ask us to stop the direct deposit. The most common reason for a missing refund is a failed direct deposit.

My bank gave me a trace that the IRS provided when the funds were returned to you. Call 1-800-829-1040 to verify your mailing address or your bank account. If youve filed your tax return but provided the IRS with the wrong bank account information dont panic.

If you still have it in. The is 221172180690023. After the money has been processed and returned an actual check in the mail will take its place.

Because Sarah earned half of that tax refund before filing for bankruptcy half of the tax refund or 1000 becomes part of her bankruptcy estate. In the spring of 2020 Sarah receives a 2000 tax refund from her 2019 tax return. The IRS sends CP31 to inform you that your refund check was returned to the IRS.

Depending on where you bank your financial institution may need you to visit a branch in person to answer questions with a banking. Generally if the financial institution recovers the funds and returns them to the IRS the IRS will send a paper refund check to your last known address on file with the IRS. Go to the File section of the HR Block Online product.

Filing taxes can be a chore yet getting a refund can be a sweet reward for your efforts. It normally takes 3-4 weeks. If the direct deposit was directly from the IRS the bank would send it back to the IRS who would then send you a check to the address on your return.

If the bank rejects a direct deposit the refund will go back to the IRS. You may call us toll-free at 800-829-1040 M - F 7 am.

Beware Of Fake Income Tax Refund Emails For All Of Those Who Have Income Tax Return And Have Received An E Mail Stating That There Tax Help Tax Day Tax Refund

How To Track Your Tax Refund S Whereabouts Cbs News

Irs Tax Refunds Delayed Why Are Refunds Taking So Long Marca

Tax Refund Is Not Free Money Tax Refund Taxes Humor Tax Return

How Can I Get Direct Deposit My Tax Refund Direct Deposited To My Green Dot Account Green Dot

2022 Tax Refund Schedule When Will I Get My Refund Smartasset

/GettyImages-92125643-b5c3bc0656ab41e48c59795ef5a318bd.jpg)

Tax Refund Missing Reasons You Never Received One

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Where S My Refund Links Financial Analysis Bank Jobs Taxes Humor

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

What Happens If Your Bank Rejected Tax Refund Mybanktracker

Will I Owe The Irs Tax On My Stimulus Payment Irs Taxes Tax Refund Tax Return

How Long Does It Take To Get A Tax Refund Smartasset

Avoid 6 Mistakes That Will Delay Your Irs Tax Refund

53 Authorization Letter Samples In Word Pdf

8 Brilliant Things To Do With Your Tax Refund This Year Best Money Saving Tips Tax Refund Saving Money Diy

Stolen Tax Refund What To Do If This Happens To You Money

Check Your Bank Account You May Have Received Your 2021 Tax Refund