hawaii capital gains tax on real estate

Power of Attorney Beginning July 1 2017 the Department will require any person who represents a taxpayer in a professional capacity to register as a verified practitioner Any person who is not required to. This is 725 of the sales price from the seller when the seller is an out-of-State resident.

Sf Ny Tokyo Housing Prices Adam Tooze Real Estate Tips Graphing House Prices

Hawaii Conveyance Tax Law.

. The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital. The Index s property tax component evaluates state and local taxes on real and personal property net worth and asset transfers. FIRPTA-Foreign Investor Tax Act.

The Tax Relief Act of 1997 stipulates homeowners do not have to pay capital gains tax on profits made from the sale of an owner-occupied home up to 250000 for a single person or 500000 per couple. While the federal government taxes capital gains at a lower rate than regular personal income states usually tax capital gains at the same rates as regular income - this is not the case in Hawaii which utilizes a lower rate than its personal income tax rate. Todays map shows states rankings on the property tax component of our 2022 State Business Tax Climate Index.

Like kind means both the relinquished sold and replacement bought properties need to be investment properties. The property tax component accounts for 144 percent of each states overall Index score. The rate slowly goes up in seven iterations until you reach the highest rate which is 1 for property transfers of 10000000 or more and 125 for non-residents.

Effective for tax years beginning after 12312020. The rate that the transfer is taxed at depends on its value. If the collected amount is too large how do you obtain a refund.

This is a Hawaii State law that requires a withholding of 725 of the sales price. For Hawaii residents transferring under 600000 the rate is 01 of the value or 015 for non-residents. It Pays To work with a Realtor.

If the appropriate Hawaii income tax return ex. Capital losses on the sale of this stock do not need to be added back to income. Form N-15 for the year is available then the owner should file the appropriate tax return instead of.

7 rows Certification for Exemption from the Withholding Tax on the Disposition of Hawaii Real Property Interests. Increased from 5 as of 2018 725 of the sales price not 725 of the gains realized. Getting ready for the sale.

Any property dispositions on or after the 15th of September that do not qualify for an exemption will now be subject to a 75 withholding rate. GET and Transient Accommodation Tax TAT of 1025-1050 is due on all short term rentals of under 180 days. Home Exemption-A Smart Way to Save.

Taxes- What to expect when selling property in Hawaii. The Hawaii capital gains tax on real estate is 725. If the 725 of sales price withholding is too large the owner files a Hawaii form N-288C after closing.

For questions concerning these issues consult with either the Hawaii Real Estate Commission your Principal Broker or an Attorney. You are subject to Hawaii capital gains tax of up to 725 on the profit gain realized on the transaction. Total capital gains are then reduced by the qualifying capital gains on line 4 or line 13.

When you live out of state and you sell property in Hawaii the transaction may be subject to tax withholding. Hawaiʻi is one of only nine states that taxes all capital gainsprofits from the sale of stocks bonds investment real estate art and antiquesat a lower rate than ordinary income. 1031 Exchange in Hawaii.

HARPTA-Hawaii Real Property Tax Act. As a real estate investor you may defer capital gains tax and recapture tax by selling one or more investment properties and purchase one or more like kind investment properties at equal or greater value. Here are the basic 1031 exchange rules.

Increases the capital gains tax threshold from 725 per cent to 9 per cent. Hawaii General Excise Tax GET of 400-450 is due on all long term rental of over 180 days. Know your flood zone.

Hawaii Department of Taxation will want at closing 5 percent of the sale. HARPTA is an acronym for Hawaii Real Property Tax Act. Lines 5 and 14 - Section 235-7a14 HRS Short-Term and Long-Term Capital Gain Exemp - tionFor tax years beginning after 2007 and end-.

The current top capital gains tax rate is 725 which critics point out is a lower tax rate than many Hawaii residents pay on their wages and salaries.

We Buy Houses Fast We Buy Houses Sell House Fast Hawaii Real Estate

We Buy Houses Georgia Sell My House Fast Home Buying We Buy Houses

Relative Value Of 100 Map Usa Map Cost Of Living

Hawaii License Requirements Us Home Inspector Training Home Inspector Home Inspection How To Become

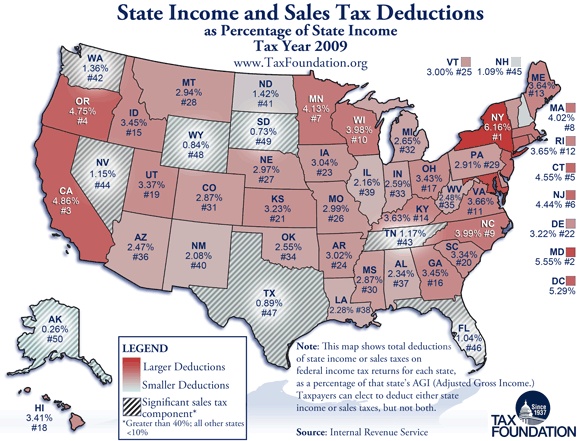

Monday Map State Income And Sales Tax Deductions Data Map Map Map Diagram

Nar Released A Summary Of Existing Home Sales Data Showing That Housing Market Activity This December Fell 3 6 Perce Sale House Surveying Real Estate Marketing

State By State Guide To Taxes On Retirees Kiplinger Retirement Advice Retirement Tax

Harpta Maui Real Estate Real Estate Marketing Maui

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Map Diagram

Buying A Condo On Maui Buying A Condo Maui Real Estate Maui

See Which States Do Not Have Income Tax Sales Tax Or Taxes On Social Security Start Packing Income Tax Tax Sales Tax

Property Investment Returns Are They Worth The Effort Wealthy Healthy Life Investing Investment Property Buying Investment Property

How To Protect Your Rental Property Being A Landlord Rental Property Landlord Insurance

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

Kaanapali Alii Maui Real Estate Kaanapali Beach Kaanapali Alii

Sell Inherited Home Fast For Cash Distressed Property Selling Your House We Buy Houses

You May Be Feeling A Little Antsy Right Now And Converting Your Garage Into A Home Gym Rec Room Or Man Cave Mig Rec Room Hawaii Real Estate Home Improvement

Harpta Maui Real Estate Real Estate Marketing Maui

Sell Your House North Carolina Selling House Sell House Fast We Buy Houses